How To Submit Form E Online Malaysia

Malay borang e.

How to submit form e online malaysia. Failure in submitting borang e will result in the irb taking legal action against the company s directors. Form e e e return form of an employer. English form e. How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967.

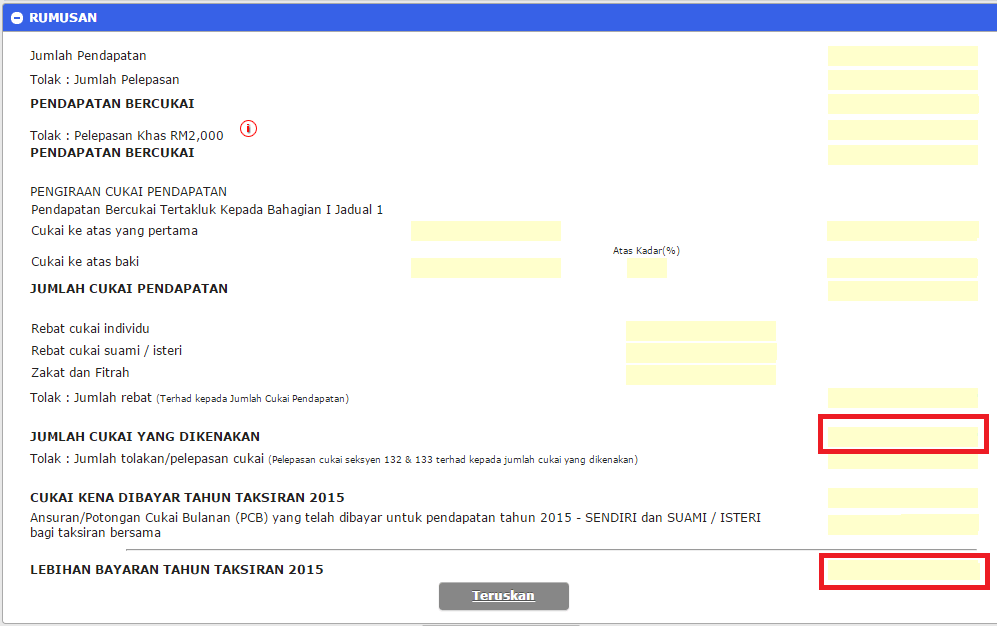

A minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e to irb as well as prepare and deliver form ea to the employees. Go to payroll info. Ezhasil system will display screen as below. On and before 30 4 2020.

Please be remind that submission by hand and postal delivery can only done by using the malay language form. Lastly select generate txt file under form e. Information available in the form is. Scroll down to year end tax and select the correct tax year.

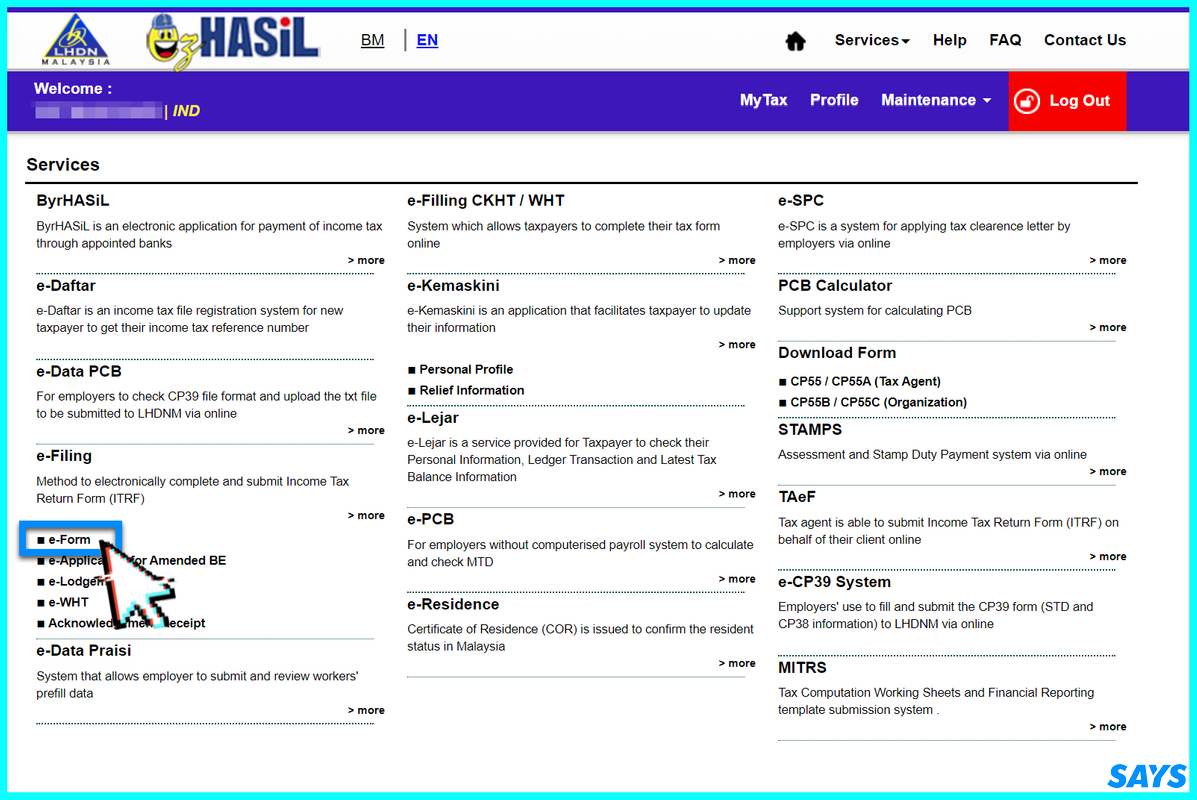

Please ensure that you have turn off the pop up blocker function on your internet browser. Click on e form link under e filing menu. Select applicable form type and year of assessment. Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.

Form c1 e c1 return form of a co operative society. So what if you fail to submit borang e. Form c e c return form of a company. We could help you to ease your job by engaging our services.