Personal Income Tax Malaysia 2019 Calculator

How to pay income.

Personal income tax malaysia 2019 calculator. More on malaysia income tax 2019. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs. How does monthly tax deduction mtd pcb work in malaysia. About simple pcb calculator pcb calculator made easy.

Here are the income tax rates for personal income tax in malaysia for ya 2019. For example let s say your annual taxable income is rm48 000. Malaysia income tax e filing guide. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes.

This personal income tax calculator will work out tax rates obligations and projected tax returns and also tax debts for certain cases. Your average tax rate is 15 12 and your marginal tax rate is 22 50. That means that your net pay will be rm 59 418 per year or rm 4 952 per month. Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia.

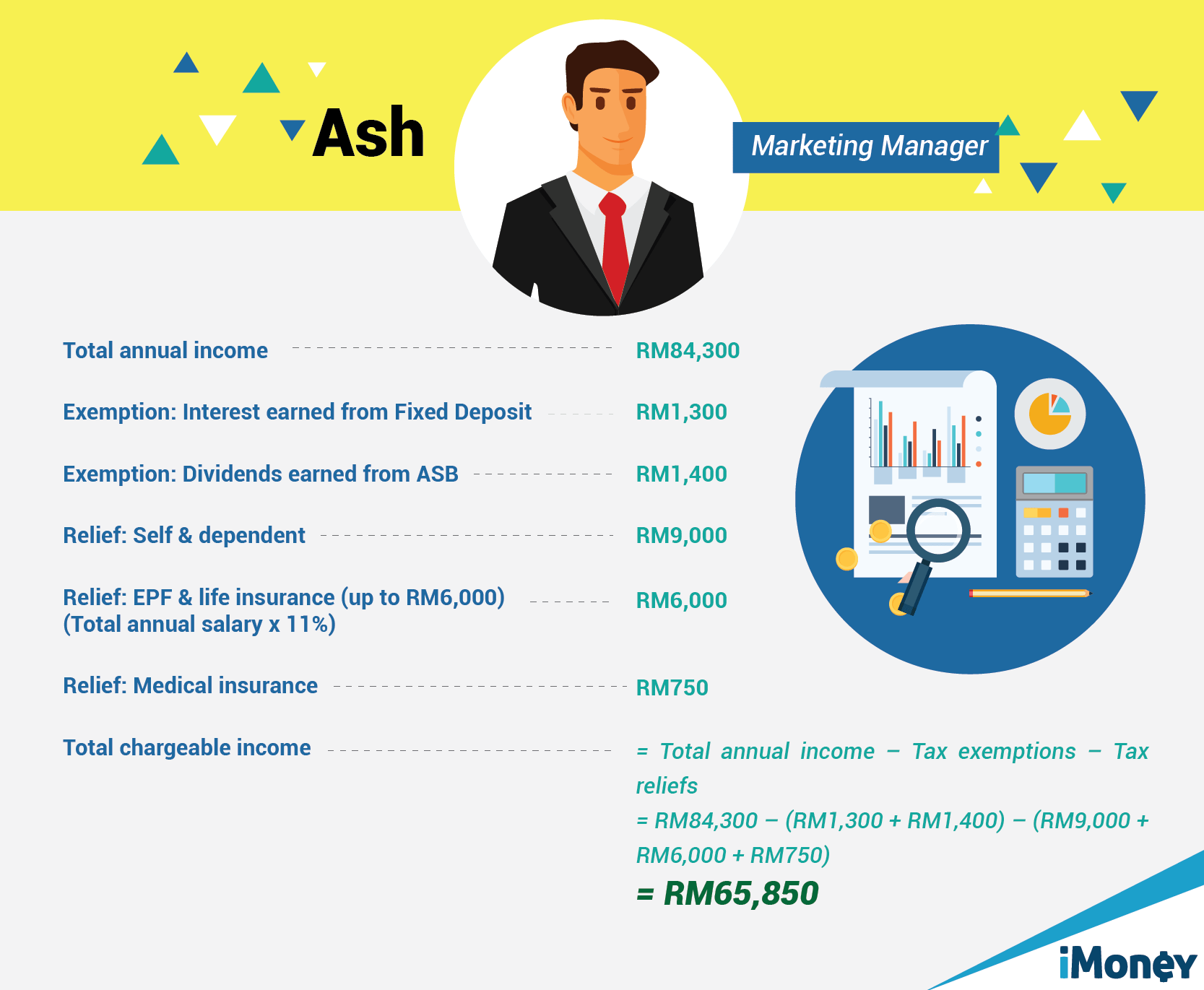

However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. About this malaysian personal income tax calculator. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.

What is income tax return. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582. What is tax rebate. Calculations rm rate tax rm 0 5 000.

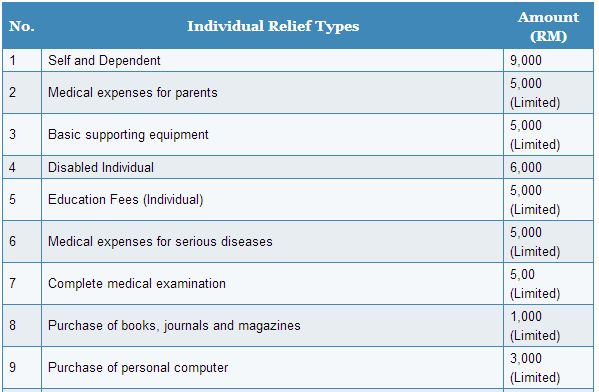

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. This marginal tax rate means that your immediate additional income will be taxed at this rate. Hopefully this guide has helped answer your main questions about filing personal income taxes in malaysia for ya 2018. The malaysia income tax calculator uses income tax rates from the following tax years 2019 is simply the default year for this tax calculator please note these income tax tables only include taxable elements allowances and thresholds used in the malaysia annual income tax calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to add to the tax calculator please contact us.

On the first 5 000 next 15 000. If you have any questions about the whole process don t hesitate to ask us in the comments and we ll do our best to help you out. On the first 5 000. The income tax rates and personal allowances in malaysia are updated annually with new tax tables published for resident and non resident taxpayers.

The tax tables below include the tax rates thresholds and allowances included in the malaysia tax calculator 2019.