Statutory Income From Employment Meaning

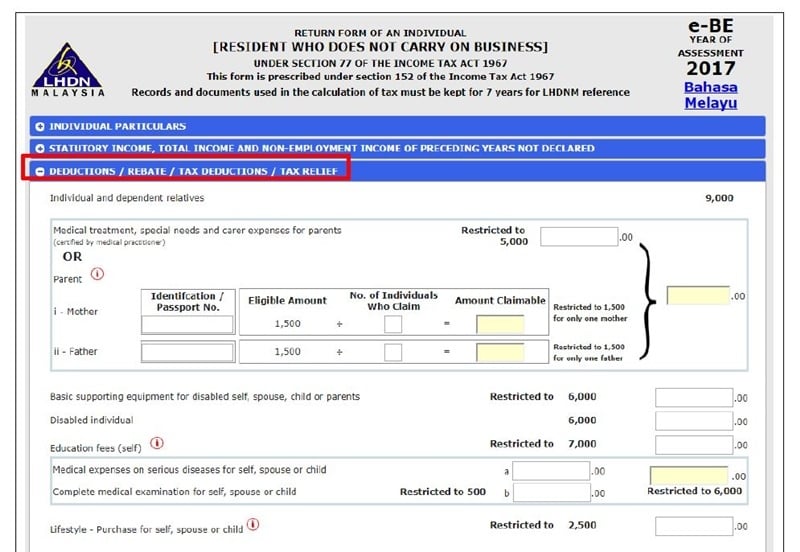

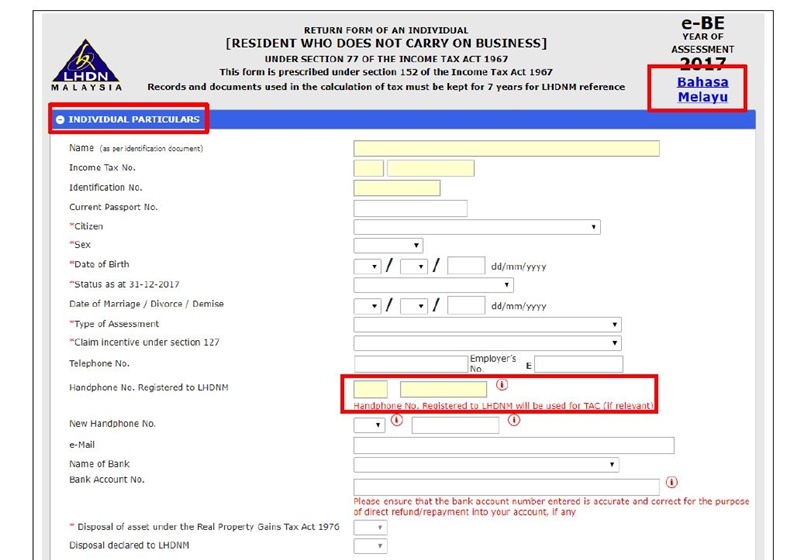

Statutory income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the income tax act.

Statutory income from employment meaning. The calculation varies by deduction type. Employers make deductions from employees wages either on a statutory or voluntary basis. Statutory deductions take various forms. Statutory compensation means the wages salaries and other amounts paid in respect of an employee for services actually rendered to an employer or an affiliated employer including by way of example overtime bonuses and commissions but excluding deferred compensation stock options and other distributions which receive special tax benefits under the code.

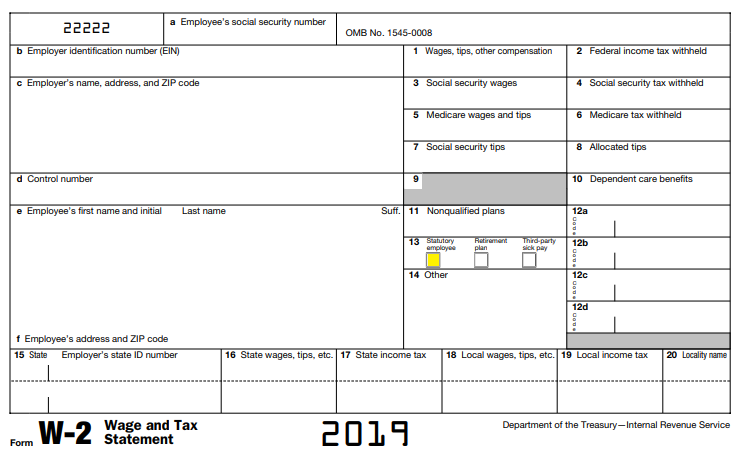

A voluntary deduction is one that the employer offers and the employee accepts. Statutory employees are unique in that they are often considered self employed although their income is reported on form w 2. Social security and medicare tax should have been withheld from your earnings. A driver who distributes beverages other than milk or meat vegetable fruit or bakery products.

Employers must withhold social security. A statutory deduction is one that federal or state law requires. Statutory income is also reffered to as take home pay as it is the amount of money you take home after all deductions. The irs classifies only four different categories of an employee who can be considered statutory.

Or who picks up and delivers laundry or dry cleaning if the driver is your agent or is paid on commission. Statutory employees include full time life insurance agents certain agent or commission drivers and traveling salespersons and certain home workers. A consequence of this income reporting requirement is that statutory employees have social security and medicare contributions made on their behalf by an employer and are not subject to self employment taxes. A statutory employee is a cross between an independent contractor and an employee.